|

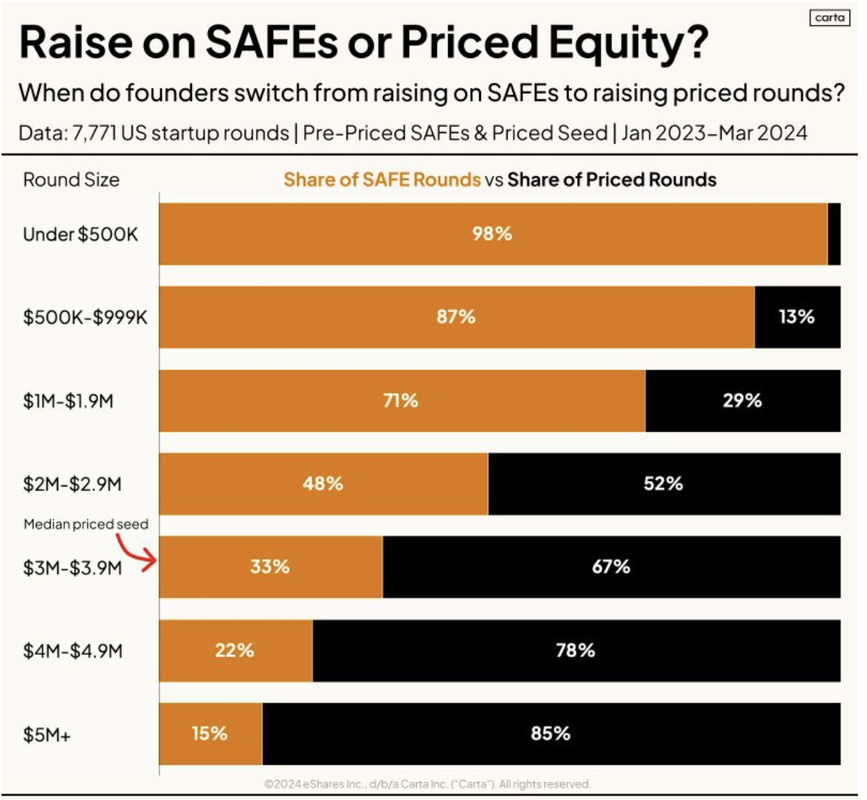

Be wary of your dilution when you stack up SAFEs before an equity round. First introduced by YCombinator in 2013, Simple Agreements for Future Equity or “SAFEs” are now one of the de jour investment vehicles for early-stage startups. The initial goal behind using a SAFE for a very early round of financing i.e., your Series Seed or Series A, was that it was a “uniform” contractual vehicle to issue shares in that future financing. In more basic terms, it benefitted the founder by saving time and legal fees and benefited the early investor with a discount in the purchase price and/or a capped value when it converted in the next round. SAFEs were also created at a time when there was uncertainty in California law about lender registration and its potential application to convertible notes, which were and still are a popular funding vehicle for very early-stage companies (For background reading on SAFEs: “Demystifying SAFEs,” 2020 DLA Piper). About half of FirstMile’s first checks to founders were done on a SAFE. Hence, we are supportive of using them when the situation warrants it. Given our sole focus on first-round investing, we have seen SAFEs work well to quickly and efficiently close a small pre-seed and then convert into a priced seed. We are not alone in using SAFEs for pre-seed rounds. According to Carta’s latest data, 71% or more of rounds under $2M were done on SAFEs. The pros and cons of SAFEs from the perspectives of investors and founders have been well debated. So we won’t bore you by rehashing over ten years of blog posts and podcasts; rather, we wish to focus this post on a more recent founder behavior of stacking multiple SAFEs (and other convertible instruments) before a priced round. The theme of this blog series is “Fundraising Fundamentals,” so we want to use this moment to remind founders of the original purpose of a SAFE and what the unintended consequences of stacking them up like stocking stuffers can be. As Charles Hudson so simply put it in 2020, you “only have 100 points of equity to split up.” (Further Reading: "We only have 100 points of equity to Split up,” Dec 2020). In peak years, say 2020- early 2022, we saw many founders open up SAFE after SAFE, raising $500k here and $1M there as investor interest came in waves. One founder explained to me that he was practicing “momentum financing” as he raised another $2M on a SAFE at a cap that was $5M more than the cap on the SAFE he had opened four months earlier to raise $1M. He had raised more than $5M in four SAFE rounds in 18 months before his Series A. He reassured me that it would all work out well as his next priced round would be at a valuation so much higher than the current SAFEs’ caps that investors had nothing to worry about. He was nearly dead on in the last part of his statement. The newest investors would be fine, and for the most part, his early investors would be ok. But it was him and his founding team I was worried about. Had he or anyone run a cap table scenario at different valuations to see how the SAFEs converted and impacted their ownership? Had anyone looked at the terms in the various SAFEs that each early investor had required? Though momentum financing may only have been a phenomenon in the peak years, the practice of stacking SAFEs has not disappeared. In this less friendly fundraising environment, we are still seeing founders stack up convertible instruments as they raise multiple bridges. So here are a few caveats for founders to consider when “stacking SAFEs”:

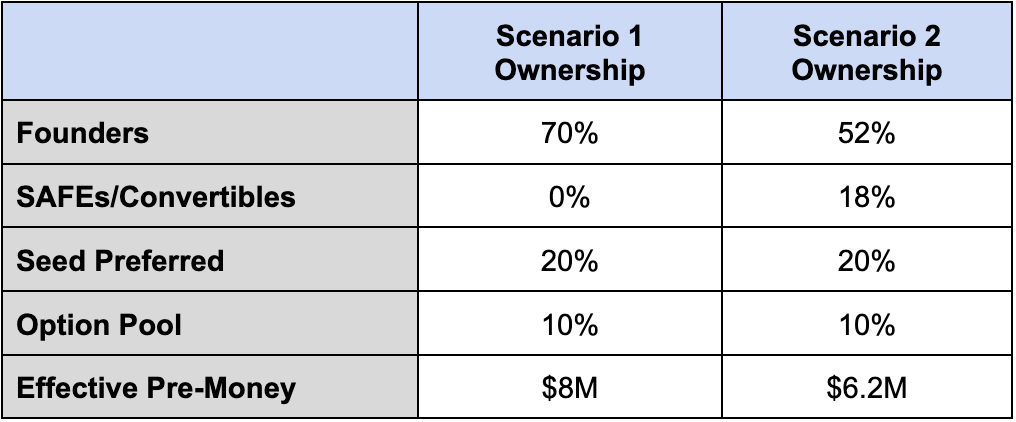

So even though the founders only raised a modest pre-seed on SAFES and notes, they converted at a discount, so instead of $2M on $8M pre, it’s effectively $2M of new cash on $6.2M pre plus all the convertibles to get to $10M post-money. If you start stacking more SAFEs beyond this simple example, it’s easy to see how that sneaky dilution can add up fast. (By the way, we tested Carta’s calculator with these scenarios and found it very helpful.

Sometimes, you need to do whatever is necessary to raise capital and keep moving, but it’s important to keep the end goal in mind and understand the long-term impact of those short-term decisions. Others have said it better:

Comments are closed.

|