Our Approach

What we invest in and how we can help.

What we invest in and how we can help

Your first check

The overriding characteristic that drives our portfolio strategy is to be your first institutional investor and work with you to achieve product market fit, typically your Series A.

If you've already raised more than $2 million, there's a good chance you are too far along for us. Pitch us >

If you've already raised more than $2 million, there's a good chance you are too far along for us. Pitch us >

A generalist, founder-first strategy

We over-index on investing in high-performing founders vs themes or industries. We prefer substance over hype. We only invest in capital efficient companies that are operating in industries we understand and can diligence quickly with our deep network of experts. Check out our portfolio >

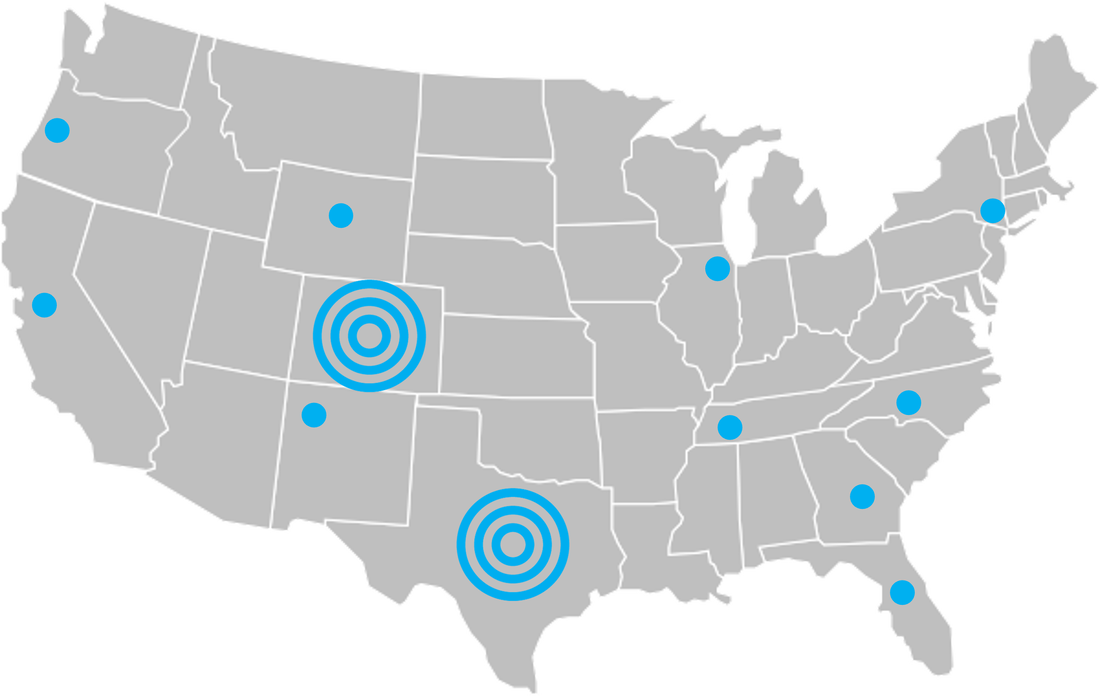

Based in Colorado and Texas

We believe that category-defining companies are built where the top tech talent is moving. Not only do we live in the states with the fastest-growing tech talent populations outside the coasts — Texas and Colorado — but we each have more than a decade of experience sourcing, picking, winning, and supporting local founders. Meet our team >

Our Commitment to Limited Partners

- Careful Custodians. We treat your money as our own, because it is: we are among our largest investors.

- Founder Focused. Your dollars go towards building companies, not fancy firm retreats.

- Open Communicators. We share information quickly and transparently and are always in touch.

Our Commitment to Founders

- First To Yes (or No). We diligence thoroughly and make decisions quickly.

- First To Invest. We invest with high conviction instead following the herd by waiting for market consensus.

- Meaningful Partnerships. We provide guidance and support while letting our founders drive the bus.

FAQs

We know raising money for your company is challenging and time-consuming. We strive for a transparent process that gets to a decision as efficiently as possible. Below are the questions we get most often about how we invest and what it's like to work with us.

Contacting

How can I get in touch with FirstMile?

We look at every submission that comes through our "Pitch Us" form. If you have a connection to someone on our team, a referral works really well, too. If it looks like a potential fit, one of our team members will reach out to you with next steps.

Pitching

What is your investment process and how long does it take?

The process varies with each company. We've made investment decisions shortly after a first meeting, and we've spent over a year getting to know teams and watching progress before finally investing. Our goal is to get to a decision—positive or negative—in the most efficient way for both of us. The typical path to an investment decision looks like this:

- Outreach. We ask for some basic information up front to understand if you are a fit for our high-level criteria. We may pass quickly, for example, if it is an area that we don't understand well and don't have interest in learning more about (i.e. FDA-approved medical devices).

- Intro Meeting. This often occurs via a 30-minute video conference. It is a chance for us to tell you more about our firm and learn about what you're working on. It gives us both a chance to decide if it makes sense to spend more time together.

- Second Meeting. This meeting is typically in-person and gives us a chance to get to know the team better and dig into the questions that came up during our intro meeting or in preliminary research we've done.

- Follow-Up. This is time for us to validate all of the great things you've told us about your company and market. This is often independent research on our part, but we may ask you to have a conversation with an expert from our network.

- Partner Meeting. Most of the above occurs with one of our investment team members. If it looks like a potential fit for our fund, we will introduce you to the other partners and give them a chance to ask questions and get to know you.

- Decision. Our decisions typically come fairly quickly after the partner meeting.

How often do you make new investments?

Our current portfolio strategy is to make 30-35 investments per fund. We typically add 8-12 new portfolio companies per year.

Do you invest in pre-seed or post-seed rounds?

The seed funding landscape has gotten more complicated with seed becoming "institutionalized" to fill the gap between angel and traditional Series A funds, and now includes rounds like pre-seed, post-seed, seed II or seed plus. We will consider anything prior to Series A, but if you've already raised more than $2 million you're probably too far along for us. We like to see a product built, or at least a prototype, and a plausible path to the next round of outside financing if things go well with the round in which we're investing.

Investing

How much do you invest?

In our current fund, we typically invest between $250,000 to $750,000 in rounds that are $500,000 to $2,000,000 total.

Do you reserve for follow on rounds?

We reserve for follow-on primarily to get to Series A. That means we may participate in a bridge round or a late seed to help get the company in position for a Series A. We do not hold any reserves for companies that are raising Series A or beyond.

Do you lead rounds, follow, or help syndicate?

All of the above. We are comfortable negotiating a term sheet and leading a round. However, for rounds above $2,000,000 it is harder for us to lead from a check-size perspective. Regardless whether we lead or follow, we will work closely with you to help you fill out the round with our network of other seed funds and helpful angel investors.

What are your return expectations?

As a rule of thumb, we like to think that any investment we make has the potential to return the entire fund. We are generally not focused on "exit strategies." We want to back mission-driven founders that will endure the challenges of growing their startup into a large and important company.

Do you take board seats?

We often ask for a board or board observer seat when it is appropriate to have investor representation and we are the best fit for the company. If we are on the board, we will transition off and make room for new investors at Series A, but we remain available to help until exit.

Working together

What can I expect from you after you invest?

Every startup takes a different path, so our involvement tends to look a little different for each one. Startups do not move in a straight line, and there will be setbacks that require hard choices. Our overarching principal is a steady hand as we've seen the ups and the downs. We aim to provide founders advice and connect them to resources that can help, and not add to their stress.

Generally, we invest most of our dollars, time, and attention in the first 12-24 months after our investment. We help syndicate the seed round(s), make customer or expert intros, set milestones for the next round, course correct, and adjust as necessary. When the timing is right, we'll help with fundraising materials and outreach to get the next round of funding complete.

Generally, we invest most of our dollars, time, and attention in the first 12-24 months after our investment. We help syndicate the seed round(s), make customer or expert intros, set milestones for the next round, course correct, and adjust as necessary. When the timing is right, we'll help with fundraising materials and outreach to get the next round of funding complete.

How do you add value to building my company outside of dollars?

Our operating principal is first do no harm. Every company is on a different path to product-market fit, so how we help each company will vary greatly. Generally, we open our networks to our founders to help them build, hire, sell, and fundraise—the four things that you need to get to the next inflection point. We also act as a thought partner for founders on priority setting for their company and board readiness and management.

FirstMile Ventures is proud to be backed by a great group of successful entrepreneurs, investors, venture capitalists, and technology executives. Wherever possible, they bring their networks and resources in support of our companies.

The state of Colorado, through the Venture Capital Authority (VCA), is also a limited partner in FirstMile Ventures; the VCA supports access to venture capital for Colorado's entrepreneurs and startup businesses. Learn more about the VCA here.

The state of Colorado, through the Venture Capital Authority (VCA), is also a limited partner in FirstMile Ventures; the VCA supports access to venture capital for Colorado's entrepreneurs and startup businesses. Learn more about the VCA here.